2024-Q3 Polkadot Treasury Report

-710a6001904e95e56285e033ae064d3f.png)

Introduction

This is our latest Polkadot Treasury Report for 2024-Q3. It follows the 2024-H1 Polkadot Treasury Report, which has gained widespread distribution in crypto news (Cointelegraph) and social media (DeFiIgnas) and sparked controversial discussions around the deployment of Treasury funds. The data in this new report shows that a paradigm change has set in and the Polkadot DAO is setting itself up for sustainable long-term budgeting.

The Polkadot Treasury is multi-asset, multi-chain in nature. It trustlessly manages over 150 million USD on 7 different chains. Polkadot’s Governance is a growing operation, reflected in the increasing number of executive bodies funded through the Treasury and the continuing deployment of capital in market operations on 4 different DeFi chains in the Polkadot ecosystem. It has also performed its first active asset swap, exchanging 1m DOT for an equal amount of MYTH tokens as part of the ongoing migration of the Mythical gaming chain into the Polkadot ecosystem.

The report comes with a balance sheet and income statement, affirming our stance that serious Web3 ecosystems need to consider traditional accounting practices to manage millions of USD in assets. The balance sheet will give a complete overview of all active accounts the Treasury manages and how assets are distributed over its operations. The income statement will break down the categories in which the Treasury spends.

We conclude the report with a discussion of long-term trends. We discuss how the Treasury is developing overall, the progress on implementing decentralized budgeting, and how the upcoming changes to inflation will influence the Treasury.

We express our gratitude to the Web3 Foundation for funding this report as part of the OpenGov.Watch initiative. Thanks also to the OpenSquare team for providing an API to fetch referenda via their dotreasury.com project, as well as the Parity data team for providing additional data.

Authors: Alice und Bob, Jeeper

Key Insights

- Balance

- 153m USD (33.3m DOT) are on the balance sheet, of which 109m USD (23.7m DOT) are free for spending.

- 6.6m USD of the cash reserves are available as stablecoins, with an additional 6m DOT (28m USD) allocated to automated stablecoin acquisition.

- Expenses

- The Treasury has spent 27.3m USD (5.1m DOT) in 2024-Q3.

- 15% of its spending went through executive bodies (Bounties and Collectives).

- 34m USD (7.4m DOT) are allocated to Polkadot’s several executive bodies for strategic initiatives like marketing, DeFi tooling, gaming, BD, etc.

- Market Operations

- Polkadot has provided 10m USD (2.2m DOT) of its owned assets as liquidity into 4 different DeFi chains.

- The Polkadot DAO has reacted to its past heightened spending by lowering expenses. In addition, an anticipated upcoming inflation reduction might also direct a more stable income to the Treasury. Read the discussion at the end fo the report to learn more more.

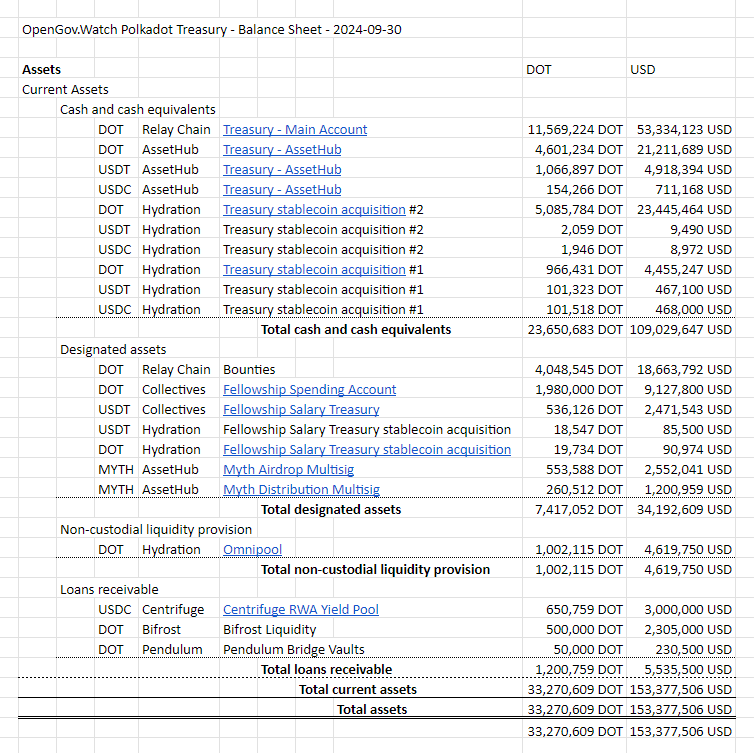

Balance Sheet

Assets

The balance comes out at 33.3m DOT / 153m USD. Considering liabilities, the surplus is 32.4m DOT / 149m USD.

We first break down some general stats before we dive into the specific categories.

General Stats

Polkadot Treasury Asset Portfolio

-0a216a542fa50d08c8d0ef99f64da901.png)

The assets are held mostly in DOT (~90%), with 5.2% in USDT, 2.7% in USDC, and 2.4% in MYTH. Polkadot’s stablecoin holdings at snapshot time made up 12.2m USD: 8m USDT and 4.2m USDC. DOT tokens in various accounts add up to 30m DOT (137m USD).

In the interest of giving a realistic picture of the value in the Treasury, we did not include memecoins. They might nominally have a high value, but because of their low liquidity, the Treasury cannot realistically assume to sell them at their nominal values. We assume that the total value of those coins is below 100k USD.

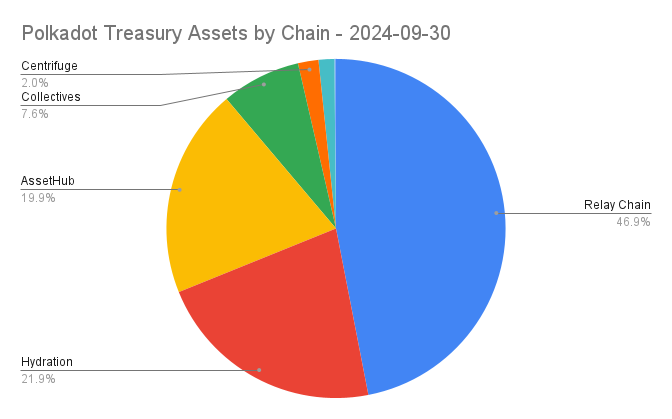

Polkadot Treasury Assets by Chain

Parachains have become a significant part of the Treasury economy, with more than 25% of the Treasury’s owned assets being deployed on various DeFi chains like Hydration (33.7m USD), Centrifuge (3m USD), Bifrost (2.3m USD), and Pendulum (230k USD). Polkadot Governance allows decisions to be executed trustlessly across all chains under the Polkadot security umbrella.

Asset Categories

-15f4cdbcd834abeefa2d2f1826fef3ca.png)

For the balance sheet, we have categorized assets as follows:

- Cash and cash equivalents: 24m DOT / 109m USD

- Designated assets: 7.4m DOT / 34m USD

- Non-custodial liquidity provision: 1m DOT / 4.6m USD

- Loans receivable: 1.2m DOT / 5.5m USD

Cash and Cash Equivalents (24m DOT / 109m USD)

This category consists of DOT, USDT, and USDC which are immediately or very quickly available for usage by the Treasury. The Treasury holds its freely available cash on the relay chain and AssetHub system chain.

- Relay Chain: 11.6m DOT (53m USD)

- AssetHub:

- 4.6m DOT (21.m USD)

- 4.9m USDT (1m DOT)

- 710k USDC (154k DOT)

In addition, two trustless and fully automated stablecoin acquisition campaigns are currently running via the Hydration DeFi chain.

- Stablecoin acquisition campaign #1 still has about 1m DOT (4.5m USD) to be swapped until 2025-Q1

- Stablecoin acquisition campaign #2 still has about 5m DOT (23m USD) to be swapped until 2025-Q3

Designated Assets (7.m DOT / 34m USD)

Designated assets are assets that are under the control of OpenGov, but are already designated for specific jobs, primarily to fund its executive bounties (bounties and collectives). In addition, Polkadot holds 3.7m USD in MYTH to be deployed through airdrops to DOT holders.

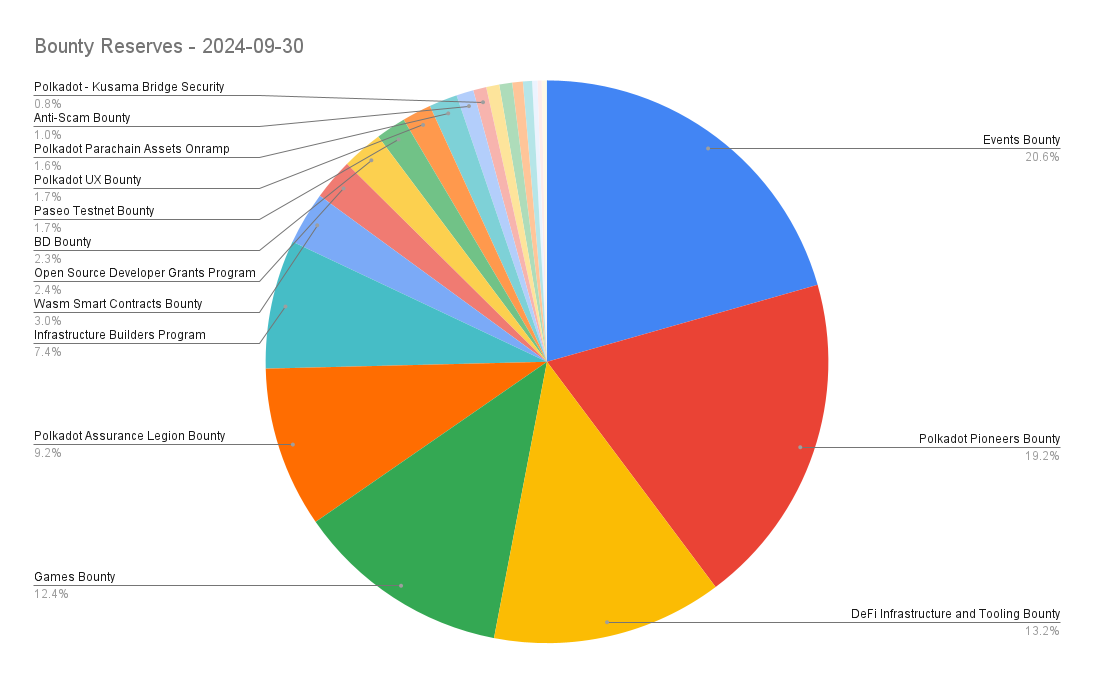

Bounties

Polkadot has 18.7m USD (4m DOT) sitting in bounties, ready to be distributed to teams that perform value-adding activities in the ecosystem. (To learn more, book a free consultation here)

Technically, it doesn’t make sense to post the following infographic, since the numbers change every month. Bounty reserves are constantly changing, as DOT is distributed to teams and individuals and bounties are refilled. We still do it to show off the great teams that are currently working in the executive branch of Polkadot Governance:

Technical Fellowship

The Polkadot Technical Fellowship is the core maintainer of the runtime. They are funded through the DAO. They have two accounts:

- Salary account: 2.5m USDT (540k DOT)

- Spending account: 2m DOT (9.1m USD)

In addition, they also trustlessly acquire USDT through Hydration, with about 38k DOT (180k USD) still about to be swapped until 2024-10.

MYTH Airdrop

As part of Polkadot’s strategic partnership with Mythical, it acquired MYTH tokens in exchange for 1m DOT. Shortly after our balance sheet date on 2024-09-30, 2.5m USD-equivalent of MYTH were distributed to DOT holders. A remaining reserve of 1.2m USD-equivalent MYTH remains within the MYTH distribution account to be used in the future.

Non-Custodial Liquidity Provision (1m DOT / 4.6m USD)

These are positions where the Treasury deploys some of its idle capital into the Polkadot economy.

- 1m DOT (4.6m USD) sits in the Hydration Omnipool as DOT LP

Loans Receivable (1.2m DOT / 5.5m USD)

These positions the custodial counterparts to non-custodial liquidity provision.

- 3m USDT have been deployed to Centrifuge RWA Yield Pool at snapshot time. (1.5m USDT were returned back shortly after the snapshot to free up for immediate spending)

- Bifrost has deployed 500k DOT into its liquid staked DOT product

- Pendulum has borrowed 50k DOT for its stablecoin bridge vaults

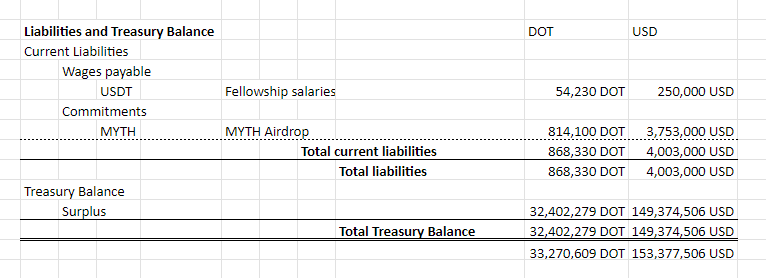

Liabilities and Treasury Balance

Liabilities are simple in Polkadot.

- Wages Payable for the Technical Fellowship come out at a maximum of 250k USD per 28-day cycle.

- The MYTH tokens are intended to be completely distributed to DOT holders. 2.5m USD of MYTH have been distributed shortly after the balance sheet was recorded. The remainder will be distributed in the future.

Comparing liabilities against assets, the Polkadot Treasury comes out with a surplus of 32.4m DOT (149m USD)

Income Statement

When presenting financial statements in crypto, the question always arises of which unit of account should be applied. Is it DOT because that is the network's native currency? Or is it USD because it is easier to interpret for the regular observer?

For the income statement, we use DOT as the primary unit of account, since it is the unit that the primary Treasury income, inflation, is based on. For the expenses section, we will additionally provide a USD-denominated table, since expenses are part of the income statement that is also relevant to understand in stable terms.

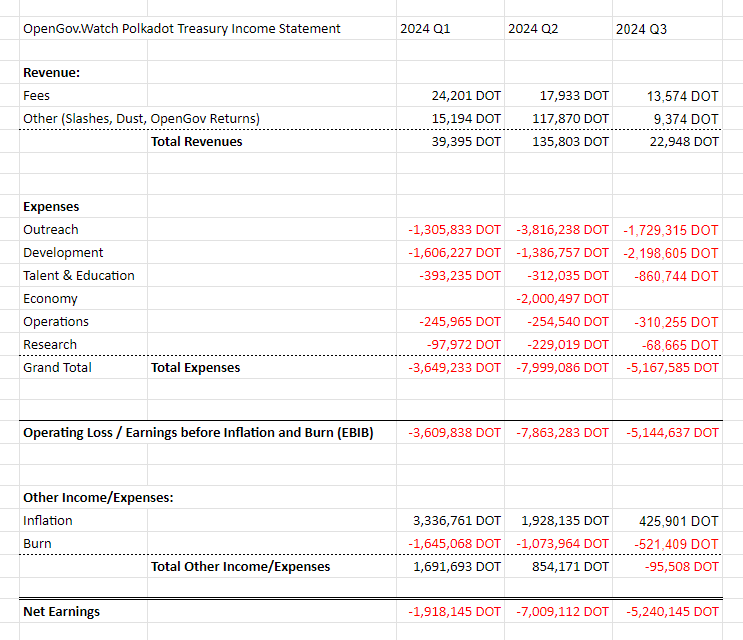

Polkadot spending has reduced from 7.9m DOT in Q2 to 5.1m DOT in Q3. Burn surpassed inflation this quarter. Relay chain fees went down and we expect them to go down as more and more functionality is moved out to system chains as part of Polkadot’s grander JAM strategy. In the future, the primary metric for value accrual in Polkadot will likely be DOT burn through core sales (as well as potential fees via the Plaza super chain project)

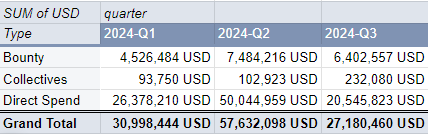

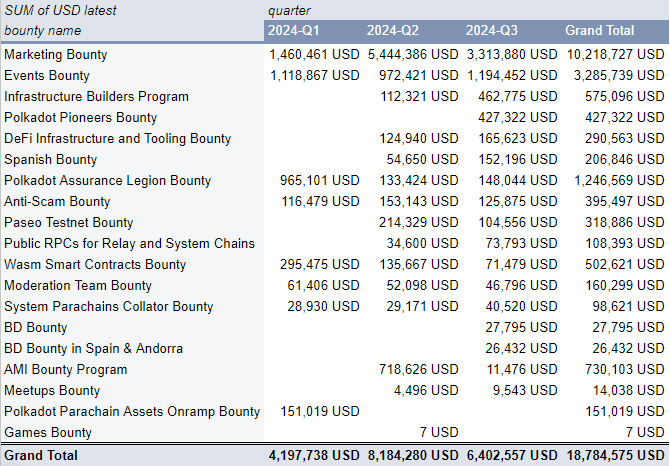

Expenses

Polkadot spending significantly cooled down in Q3, with 27m USD (5.2m DOT) spent—half as much USD equivalent as in Q2 of this year. Let’s look at the DOT and USD-equivalent values of spending in the first 3 quarters of the year.

-710a6001904e95e56285e033ae064d3f.png)

Before we dive in, let’s look at what categories Polkadot spends money on.

Categories

The categories described in this chapter have been developed over the last year by creating several budget reports. Via a discussion post on the Polkadot forum, the categories were refined. Feel free to suggest improvements in the thread to be considered for future reports.

- Research: Protocol research, reports, and analytics, UX & DX, scam prevention, audits (security, QA)

- Development:

- Software (and in the future possibly hardware) development that directly affects relay and system chains or can be used to use them: wallets, bridge, Substrate clients, light clients, multi-sig support, privacy, indexing, tools, protocol subsidies (common good chains), protocol & software incubation, SDKs (e.g. Web3-to-Web2 wrappers), smart contract tech, ZK,

- Polkadot protocol (Fellowship payroll)

- Operations: software, hardware, and service costs incurred to operate…

- the network: RPCs, archive nodes

- auxiliary services: explorers, indexers

- legal costs (foundations)

- Outreach (Marketing, BD, Community Development):

- Marketing: media production, PR, advertising

- Business development: consulting, solution architecture

- Community development: conference hosting, conference attendance, local outreach, events, community building, ambassador program

- Talent & Education: education, hackathons, recruiting, talent incubation (e.g. PBA)

- Economy: Liquidity Incentives to stimulate the economy

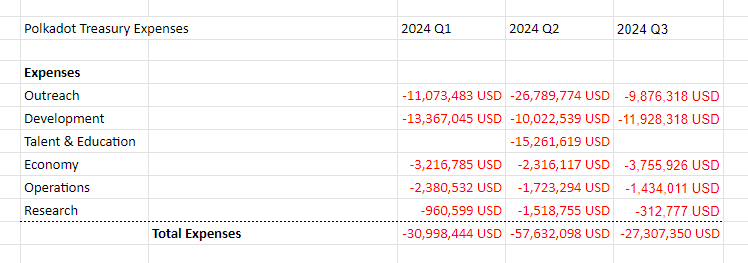

27m USD (5.2 m DOT) were spent in Q3. That is about half the USD-equivalent of Q2 (58m USD → 27m USD) and a sharp decline in DOT-equivalent spending (8m DOT → 5.2m DOT).

Outreach dropped the sharpest, from 27m USD to 9.9m USD. Development stayed fairly stable (10m USD → 11.9m USD). Operations costs also stayed at their previous level (1.7m USD → 1.4m USD). Talent & Education spending is up (2.3m USD → 3.8m USD). Research spending is at a low this year (1.5m USD → 310k USD). There were no economic stimuli proposals approved this quarter.

-ad88636b45482664c0b1fd624a4b52e8.png)

Comparing the all-time distribution (above) with the one from this quarter (below), we can see that they look fairly similar. The “Economy” category was only distributed in 2024-Q2, so it still represents a bit of an outlier. Overall, Outreach maintains its all-time ratio, while Development and Talent & Education are up.

-6188bf9d286216d99261105ae88f102b.png)

Now let’s dive a bit into each category!

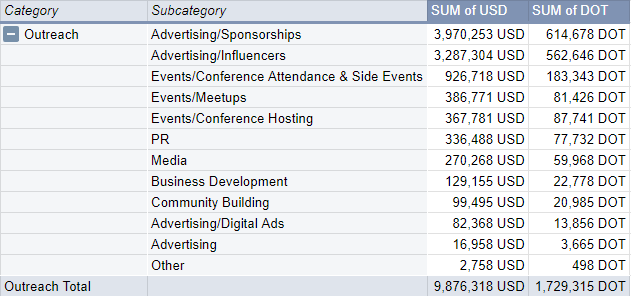

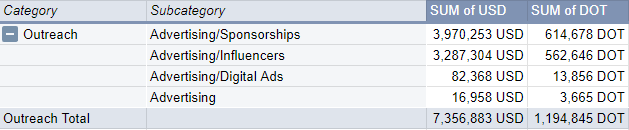

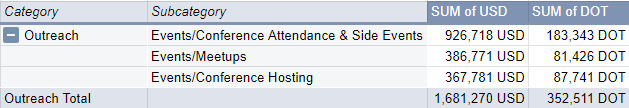

Outreach

9.9m USD was spent on outreach (vs. 26.8m USD in Q2), which included activities such as marketing, business development, and community development—everything intended to attract new users, developers, and businesses to the ecosystem.

The subcategories of advertising and events are so differentiated that we group them into further sub-subcategories.

Advertising (7.4m USD) made up the majority of the outreach efforts this quarter. Top-ups were given to the sponsorship deals (4m USD) with Inter Miami (3.9m USD) and HEROIC (84k USD) while influencers (3.3m USD) earned their living through agencies such as Pineta Digital (2.2m USD), EVOX (650k USD), Pink Brains (330k USD), and Lunar Strategy (50k USD).

1.7m USD were spent on events. Polkadot attended Conferences & Side Events (930k USD) such as Token2049 (370k USD), the Asia Blockchain Summit 2024 (105k USD), the Korea Blockchain Week 2024 (103k USD) and 10 others. Dozens of smaller meetups (387k) came out at about the same value as Conference Hosting (368k USD) for the Sub0 Developer Conference.

Other subcategories under outreach: PR (336k USD) with Chainwire (319k USD) and MarketAcross (17k USD) providing services to the ecosystem. Media (270k USD) went mostly to the Spanish Bounty (192k USD), the Behind the Code interview series (44k USD), The Dots Magazine’s meme galore (37k USD) and the Spanish Editorial Board (35k USD). Business Development (129k USD) and Community Building (99k USD) comprise the remaining subcategories.

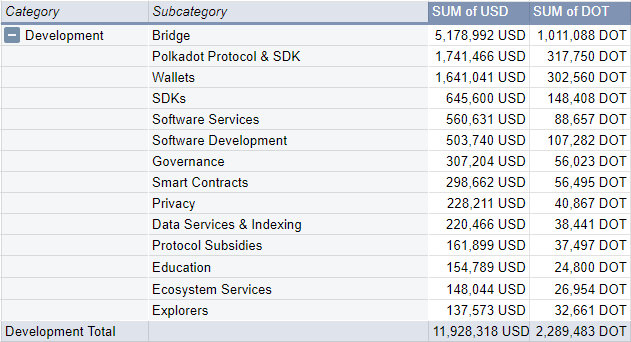

Development

11.9m USD was spent on Development (vs. 10m USD in Q2). The biggest position is for the Polkadot-Ethereum bridge (5.2m USD), which went live recently. Wallets (1.6m USD) funded Subwallet (810k USD), and three new entrants: new Kampela (640k USD), Polkasafe multisig (160k USD), and PlutoWallet (35k USD).

To develop the Polkadot Protocol & SDK (1.7m USD) the C++ implementation KAGOME received 820k USD. OpenZeppelin developed new templates for 250k USD while Fellowship salaries added up to 232k USD. SDK (645k USD) consisted of PAPI (560k USD) and Reactive DOT (88k USD). Software Services (560k USD) is 3rd party services that got funded by Polkadot.

Software Development (504k USD) is a catchall category for all other development costs that don’t fit into other categories. AssetPortal (145k USD) and Kheopswap (59k USD) are both DEX UIs built for the AssetHub native DEX features. dAppForge (79k USD) is an AI plugin for Polkadot developers. Polkadot also funded the RegionX Coretime Marketplace (54k USD) to augment its new on-chain blockspace markets.

Governance (307k USD) funded tools for OpenGov, including the Bounty UI (170k USD) and the Subsquare Collectives support (138k USD). Smart Contracts (299k USD) funded Phink - the ink! fuzzer (192k USD) and 3 other projects. In the Privacy (228k USD) category we see a development project for the fully holomorphic encryption for WASM (195k USD) and the privacy sidechain Incognitee (33k USD). On the other side for Data Services & Indexing (220k USD) we register user segmentation and conversion for Ink!, Pallets & XCM (215k USD) as the major project of the quarter.

Further subcategories here were Protocol Subsidies (162k USD), Education (155k USD), Ecosystem Services (148k USD), and Explorers (138k USD).

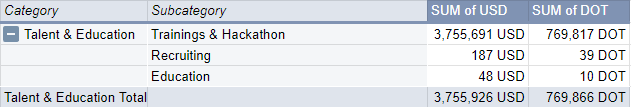

Talent & Education

Talent & Education comprised 3.8m USD (vs. 2.3m USD in Q2). The main subcategory is Trainings & Hackathons (3.8m USD) with 2.2m USD for the Polkadot Blockchain Academy and the remainder for various hackathons. The subcategories Recruiting (187 USD) and Education (48 USD) might look amusing this time but reflect that the Treasury also gives out tips to ecosystem participants that do small value-adding work like creating standardized interviews or writing guides and asking for modest tips.

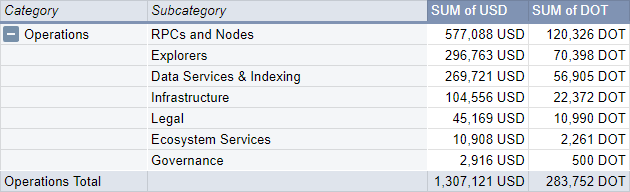

Operations

Operations cost 1.4m USD in Q3 (vs. 1.7m USD in Q2). RPCs and Nodes (577k USD) keeps the network running, paying 462k USD to the Infrastructure Builders Program Bounty, 74k to the Public RPCs for Relay and System Chains Bounty, and 40k to the System Parachains Collator Bounty. This makes this whole subcategory covered under bounties! Explorers (297k USD) covers Subscan’s (259k USD) cost for 9 months and some other licenses (38k USD). Data Services & Indexing (270k USD) went to Subsquid (234k USD) and Polkawatch (35k USD). Infrastructure (104k USD) exclusively covered the Paseo Testnet Bounty. Polkadot spent 45k USD on Legal costs to acquire IP rights through the Polkadot Community Foundation. Minor positions were spent on Ecosystem Services (11k USD) and Governance (3k USD)

Research

313k USD were spent on Research (vs. 1.5m USD in Q2). Security (183k USD) consisted of a codebase audit for ink! 5.0. The Anti-Scam bounty consumed 125k USD. Minor positions were spent on Smart Contract (2k USD) and Governance (1k USD) research.

Bounties

Let’s look at Bounties and the Collective spends. They are the two types of executive bodies that simplify OpenGov by reducing the volume on the general voting tracks and instead directing funds to expert bodies to decide on spending. In the table above we can see that bounty spending was more consistent than direct spending. Collective spending has trended up. Keep in mind that these costs were already represented in the previous chapters and this is just a different perspective to represent them.

We begin with bounties.

Overall, 18.8m USD have been flowing through bounties this year so far. 6.4m USD in Q3.

The marketing bounty (3.3m USD) kept dominating bounty spending, even though the community has temporarily halted the bounty to restructure it and consider a new strategy. The events bounty (1.2m USD) has also shown consistency and is known to have established good internal operations.

Overall we can observe that more bounties are operational than before and that best practices are starting to get established.

Fellowship

Fellowship salary claims are rising. These are the claims for the first half year of its operations:

- 2024-04: 16,670 USD

- 2024-05: 35,000 USD

- 2024-06: 51,253 USD

- 2024-07: 67,080 USD

- 2024-08: 71,670 USD

- 2024-09: 93,330 USD

Discussion

On the Topic of the Treasury Burn Rate

Our previous report triggered quite some controversy, claiming that the Treasury has about 2 years of runway left (while acknowledging that the volatile nature of crypto-denominated assets makes it hard to predict anything with confidence). The argument stemmed from the fact that the Treasury had 32m DOT (200m USD) in liquid assets available and an extrapolated net loss of 17m DOT (108m USD) per year. At this rate, we argued, the Treasury could be depleted within 2 years. With another 3 months of data on our backs, let’s reevaluate the situation.

Inflation

The biggest argument against the idea of a “runway” is that the Treasury cannot run out of money since inflation always refills it. That is technically true but ignores the fact that inflation cannot be arbitrarily large. Inflation is a tax on non-staking token holders and needs to be considered wisely. In addition, the existing Polkadot Treasury still exceeds one year of inflation, which could be considered its reserve. The rate of spending this year is on track to deplete reserves. This makes sense given the current strategy, but should nonetheless be reflected honestly in the discussion.

Stakeholders recently signal voted to lower inflation and simultaneously provide the Polkadot Treasury with an increase in income, cutting down the high APR of stakers to more reasonable levels. In 2025, the Treasury can roughly expect an income of 18m DOT (83m USD). This translates to a budget of 4.5m DOT per quarter without touching Treasury reserves.

Revisiting the expenses, we see that they are outpacing a future expected inflation of 4.5m DOT per quarter (3.6m DOT in Q1, 7.9m DOT in Q2, 5.1m DOT in Q3), marked with the line in the graph below.

-a43963b45eb6b52b7da6c2235a033966.png)

Current Treasury Burn

The Treasury Surplus went down from 38.2m DOT in Q2 to 32.4m DOT in Q3. A burn rate of 5.8m DOT per quarter or 23.2m DOT per year. Extrapolating from the total spend of the first 3 quarters of the year (16.8m DOT) to the full year gives a similar value: 22,4m DOT

Weighing this against the future expected inflation of 18m DOT per year would give a net loss of ~5m DOT per year. The Treasury balance of 32.4m DOT is a safe 6.5x multiple of that. Considering just cash and cash equivalents of 23.6m DOT still gives a 4.7x multiple.

So in comparison to the previously described “runway” of less than two years, this additional Treasury income is coming just in time.

In the long term, the DAO still needs to come up with a strategy to spend its funds sustainably. Expecting favorable market conditions in the future is nice. Having a good plan is better.

Budget

Creating a budget is a wish in the community that has been expressed for over a year now. How to get there in a DAO that is as complex and rich in different stakeholder interests as Polkadot is a difficult-to-answer question. The authors have published a proposal that is based on bottom-up principles and Polkadot’s developing legislative procedures here.

Notes

- The raw data for this report can be found in the following places:

- Data Acquisition Methodology

- We extend our thanks to the Subsquare, the Parity data team, and lolmcshizz for providing valuable data and inputs for this report.

- Balance sheet values

- intra day exchange rates for DOT and MYTH were retrieved on 2024-09-30

- the intra-day exchange rate of 0.2502 MYTHUSD was retrieved on

- token holdings on accounts were retrieved via Subscan

- DOT value in the Hydration Omnipool are retrieved from the Hydration UI

- Outstanding wages payable are retrieved from the SubSquare collectives UI

- Bounty holdings are retrieved from SubSquare

- Income Statement

- Were fetched by reverse-engineering Subsquare’s doTreasury API and transforming the data. Code is here

- Determination of DOT value:

- spend and spend_local DOT value is taken into consideration

- Bounty and XCM send values are assumed 0. Typically they just move DOT into designated accounts and later spending can then be recognized

- batch calls are traversed

- If the value is expressed in USDT/USDC, we calculate the DOT value of the closing price on the day of execution

- Determination of USD value

- If the value is given in USDT/USDC, that value is taken

- In all other cases, we use the DOT value and multiply with the closing price of the day of execution

- Full bounty spend: A single instance in the relevant timeframe is recorded. This was just manually taken from Subscan

- Inflation, Burn, Fees, and other values have been provided on a monthly basis from the Parity data team.

- The report uses a cash accounting (for the most part)

- This means that expenses and income are recorded are made, not when the actual service is delivered.

- We strive to arrive at accrual accounting, as it is more in line with international accounting practices. But we lack the necessary data from spends and bounties.

- This can create distortions in many ways, for example when payments are made that extend over the measurement period, or when transactions (like the Myth swap or the Inter Miami deal) are prepaid but not yet executed (and might still fail and get refunded). Another example is the new spend() extrinsic, which we account for at the time of referendum execution.

- The current report bases its numbers on the execution date of proposals, which can deviate from the time tokens are spent. For past reporting, we only represented direct spending from the Treasury and it was convenient to represent them on the date of spending.

- Expenses

- Loans and liquidity provisions are not represented in the income statement, as they do not count as expenses per accounting standards. They will show up on the balance sheet

- Bounty creation & bounty refills are also hidden since these are not yet expended but rather become designated assets. Once they are spent via child bounties (or in a single instance fully), expenses are accounted.

- Refunds: We record income from transfers to the Treasury. These transactions are most likely refunds from OpenGov proposers that have been overpaid or decided not to deliver. But tracking the origin of these transactions is out of the scope of this report

- Income Statement

- some child bounties were missing in the last report. the current report corrects for this

- Future Reports

- transition to accrual accounting

- match the values of net income in the income statement with retained earnings in the balance sheet

- forex earnings/losses in the income statement

- would be interesting to see stable vs. DOT payout flows

- complaints

- when a collective pays out tokens from their sub-treasury, no proper events for withdrawal and deposit are emitted - https://collectives-polkadot.subscan.io/extrinsic/4473407-2

- we can’t track bounty spends if the bounty decides to liquidate to fiat to retain value. this leads to a spend being recorded at the time of liquidation

- This report is created by humans and might contain errors. Don’t trust, verify.