2024-H1 Polkadot Treasury Report

This is our latest Polkadot Treasury Report for the first half of 2024. It follows the 2023 Polkadot Treasury Report. For the first time, it shows the full amount of assets under the control of the Treasury over 3 different chains and numerous sub-accounts.

Polkadot’s Treasury is becoming more complex and harder to grasp. Polkadot is spending directly as well as allocating value in bounties and collectives to be spent in the future. It holds not only DOT, but also USDT and USDC stablecoins on the AssetHub chain, making the Treasury multi-asset and multi-chain.

To give a complete picture, this report is much bigger in scope than previous ones. It attempts to come closer to traditional accounting reporting practices. While past reports focused solely on direct spending, the current report includes a complete income statement comparing revenue and expenses. Additionally, it also comes with a balance sheet capturing the evolving multi-chain and multi-asset nature of a Treasury that reflects value allocated in loans and bounties.

We express our gratitude to the Web3 Foundation for funding this report as part of the OpenGov.Watch initiative. Thanks also go to the OpenSquare team for pioneering Treasury analytics and providing important data via dotreasury.com, as well as the Parity data team for providing additional data.

Authors: Alice und Bob, Jeeper

Key Insights

- The Treasury has spent 87m USD (11m DOT) in the first half of 2024. 13% of its spending is coming through executive bodies (bounties and collectives)

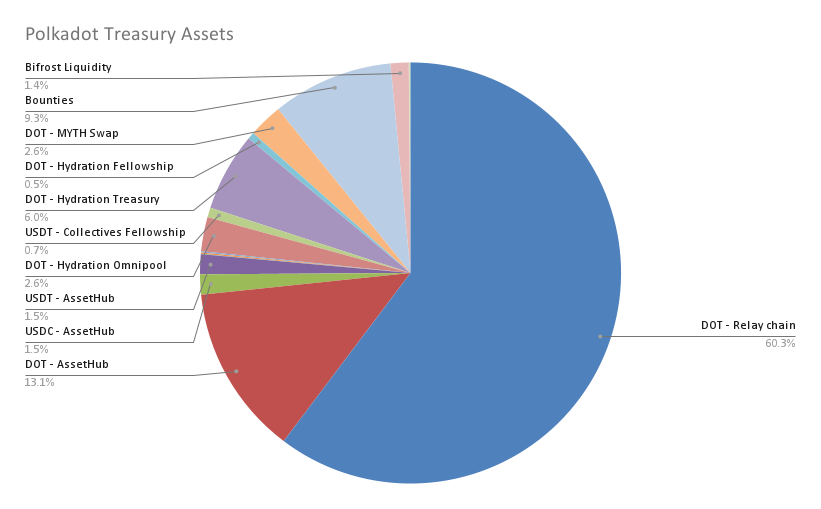

- The Treasury manages 245m USD (38m DOT) in assets, of which 188m USD (29m DOT) are liquid.

- Stablecoins: 8m USD of its cash reserves are in the form of USDT & USDC stablecoins, with an additional 2.5m DOT (16m USD) allocated for stablecoin acquisition.

- Designated assets: 24.5m USD (3.8m DOT) are allocated to its several executive bodies (collectives and bounties) to be used in strategic initiatives like marketing, DeFi tooling, gaming, BD, etc. 6.4m USD (1m DOT) are allocated for airdrops in the gaming vertical.

- Polkadot has provided 1.6m DOT (~10m USD) of its owned assets as liquidity into DeFi markets in the ecosystem.

- At the current rate of spending, the Treasury has about 2 years of runway left, although the volatile nature of crypto-denominated treasuries makes it hard to predict with confidence. This has sparked discussions ranging from a stricter budgeting approach to a change in the inflation parameters of the system. Read to discussion at the end of this report to learn more.

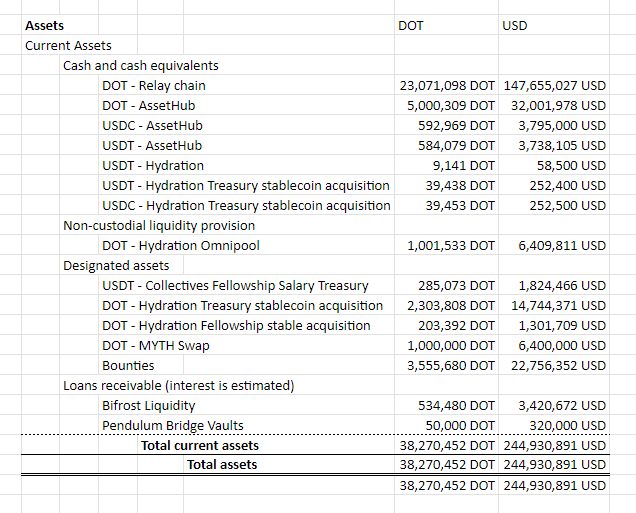

Balance Sheet

Assets

Polkadot has assets equivalent to 38.2m DOT / 245m USD.

For the balance sheet, we have categorized them as follows:

- Cash and cash equivalents: 29m DOT / 188m USD

- Non-custodial liquidity provision: 1m DOT / 6.4m USD

- Designated assets: 7.3m DOT / 47m USD

- Loans receivable: 5.8m DOT / 3.7m USD

In the following chapters, we will break each of these categories down and explain the positions.

Cash and Cash Equivalents

Total: 29m DOT / 188m USD

This category consists of DOT, USDT, and USDC that is immediately available for usage by the Treasury. The Treasury’s liquid assets are spread between three chains. We will list them here and what they are. In brackets, we will give the equivalent value in the opposite denomination.

- Relay chain: 23m DOT (148m USD)

- AssetHub: Total value of 6.2m DOT / 40m USD

- 5m DOT

- 593k USDC

- 584k UDST

- Hydration: Total value of 79k DOT / 505k USD

- 252k USDT

- 253k USDC

Non-Custodial Liquidity Provision

Total: 1m DOT / 6.4m USD

Polkadot has provided 1m DOT in single-sided liquidity into the Hydration Omnipool. Following Referendum 560, the position was created in a non-custodial manner with the help of Hydra Governance.

The position can be seen here and is currently worth 1,001,533 DOT (6.4m USD)

Designated Assets

Total: 7.3m DOT / 47m USD

Designated assets are allocated by the Treasury for certain purposes, but have not yet been deployed.

- 1,8m USDT on AssetHub - The Fellowship salary account

- 2.3m DOT on Hydration - An ongoing streaming swap of the Treasury from DOT to USDT (instructed through Ref 457)

- 203k DOT on Hydration - An ongoing streaming swap of the Fellowship to fill the salary account with USDT (instructed through Ref 231)

- 1m DOT in a Multisig - Allocated for a token swap against 20m MYTH tokens. To be distributed to the Polkadot community (instructed through Ref 643)

- 3.6m DOT in Bounties - All bounties hold DOT that is allocated for its specified purposes.

Loans Receivable

Total: 580k DOT / 3.7m USD

Polkadot has given 1-year loans to inject liquidity into DeFi protocols in the ecosystem.

- 534k DOT - Bifrost has taken a 500k DOT loan to mint vDOT and increase its presence in the ecosystem. The DOT is staked and Bifrost will pay back with the accrued interest. (instructed through Ref 432)

- 50k DOT - Pendulum has taken a 50k DOT loan to provide collateral for its Spacewalk bridge vaults and bring new stablecoin liquidity from Stellar into the Polkadot ecosystem (instructed through Ref 748)

Liabilities and Treasury Balance

On-chain Treasuries have remarkable balance sheets when compared with traditional entities. So far, it only has current assets (assets that are available within 1 year). On the liabilities side, the situation is similarly simple. Polkadot might pay up to 250k USDT in salaries per month.

Which leaves the Treasury with a comfortable surplus worth 244,680,891 USD.

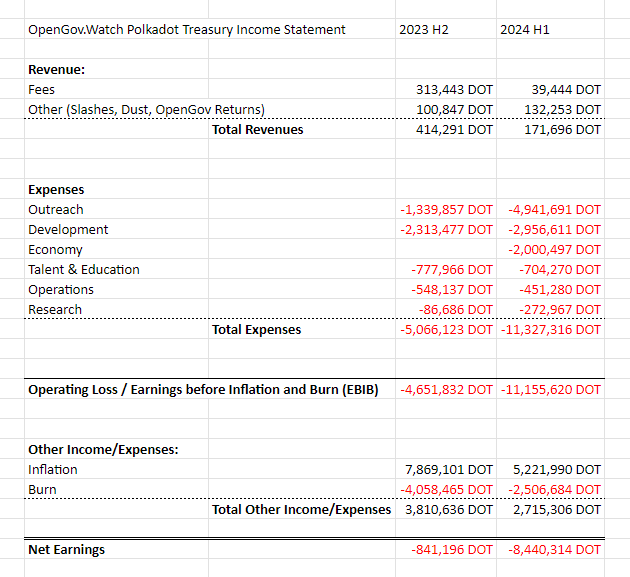

Income Statement

Polkadot invests heavily in growth and has spent 11m DOT (87m USD) in the first half of 2024. Before we dive a little bit deeper into its spending, let’s get an overview first.

We see that direct revenue from fees is still marginal. Polkadot made 300k DOT from fees in 2023-H2 from a short-lived inscriptions campaign. Fees under regular conditions are pretty stable with about 20k DOT per quarter. Other sources of revenue are typically transfers from accounts that return funds that they received and pay them back for various reasons.

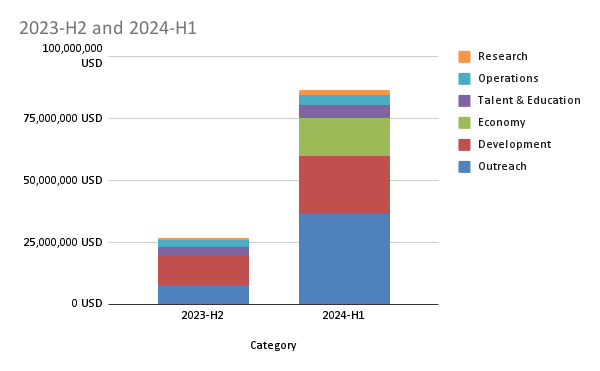

On the expenses side, we will do a deep dive in the next chapter, but let’s acknowledge that the DOT spending grew by 2.4x compared to 2023-H2.

We have marked out inflation and burn at the bottom of the income statement since these are factors outside of the regular “operations” of the Treasury, similar to interest, taxes, depreciation, and amortization in traditional accounting.

Expenses

Let’s compare the last two half-years and then dive deeper into the different spending categories. Overall we can observe a huge jump in spending, as proposals got more ambitious in scope and ask size recently. The good news is that the average DOT price has gone up this half-year, resulting in more bang for the DOT, highlighted by the fact that DOT spending went up by 2.4x, but the USD-equivalent value is up 3.2x in the same time frame.

At first sight, we can observe that categories like outreach, development, and economy have grown significantly. But what do they mean?

Categories

The categories described in this chapter have been developed over the last year by creating several budget reports. Via a discussion post on the Polkadot forum, the categories were refined. Feel free to suggest improvements in the thread to be considered for future reports.

- Research: Protocol research, reports, and analytics, UX & DX, scam prevention, audits (security, QA)

- Development:

- Software (and in the future possibly hardware) development that directly affects relay and system chains or can be used to use them: wallets, bridge, Substrate clients, light clients, multi-sig support, privacy, indexing, tools, protocol subsidies (common good chains), protocol & software incubation, SDKs (e.g. Web3-to-Web2 wrappers), smart contract tech, ZK,

- Polkadot protocol (Fellowship payroll)

- Operations: software, hardware, and service costs incurred to operate…

- the network: RPCs, archive nodes

- auxiliary services: explorers, indexers

- legal costs (foundations)

- Outreach (Marketing, BD, Community Development):

- Marketing: media production, PR, advertising

- Business development: consulting, solution architecture

- Community development: conference hosting, conference attendance, local outreach, events, community building, ambassador program

- Talent & Education: education, hackathons, recruiting, talent incubation (e.g. PBA)

- Economy: Loans, Liquidity Incentives, Active Asset Swaps

A shift in spending priorities

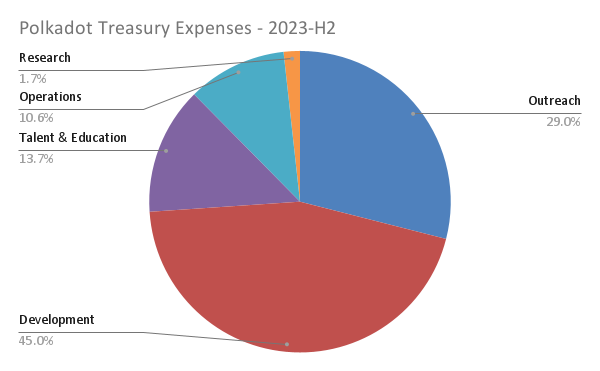

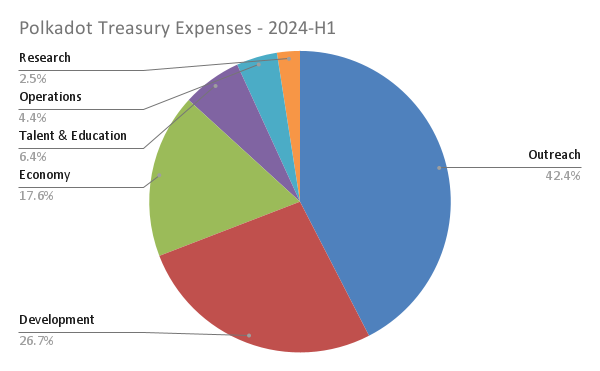

Comparing the last half of 2023 and the first half of 2024 shows a clear shift in relative priorities Outreach grew from 29% to 42%, supporting the economy takes up 18% now, and research is up from 1.7% to 2.5%. On the other hand, development, talent & education, and operations have roughly halved in relative size.

Looking at absolute values though, we see that every individual spending category has grown when we stack them up next to each.

Now let’s dive a bit into each category!

Outreach

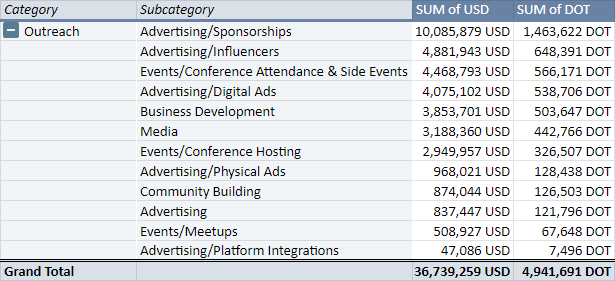

37m USD were spent on “outreach”. But what do we mean by that? Under outreach, we describe every spend that is intended to attract new users, developers, and businesses into the ecosystem. This spans from advertising and media, online and offline community building and events, to big conferences and business development.

Some subcategories deserve the grouped together, such as advertising and events.

In total, advertising makes up half (21m USD) of the outreach effort. Sponsorships (10m USD) include the 1m DOT (6.8m USD) sports sponsorship deal with a prestigious soccer club as well as sponsoring the race car driver Conor Daly (1.9m USD) and recently, a partnership with the e-sports tournament organizer HEROIC (1.3m USD). Influencers (4.9m USD) are covered through agencies such as EVOX (2.2m USD), Lunar Strategy (1.3m USD), Chainwire (490k USD), and Unchained (460k USD). Digital Ads (4m USD) are placed via CoinMarketCap (1m USD) and EVOX (900k USD).

Events add up to 7.9m USD, with 4.5m USD going to numerous conference attendances and side events (Polkadot Decoded China 560k, 540k for 3 'bash' parties, Token2049 side event 420k). The main events, Polkadot Decoded and Sub0 in total have been funded with 2.9m USD, although we need to consider that costs for those events should be summed up at the end of the year.

Several BD (3.9m USD) opportunities were taken up, such as a partnership with The Tie for access to speaking opportunities conferences for institutions (1m USD), integration of insurance provider Avata (550k USD), and recruiting future partners to apply for the Decentralized Futures program through Missing Link (540k USD).

The production of Media (3.2m USD) is spread across several actors, with the biggest ones being the Kusamarian (530k USD) and the Behind the Code docuseries (350k USD).

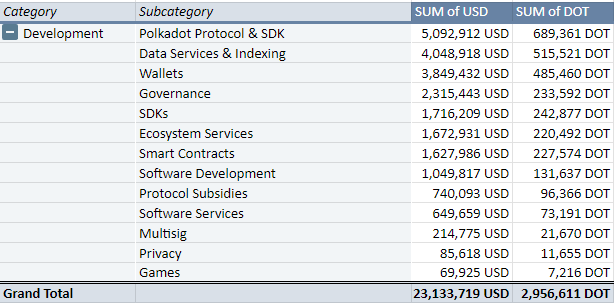

Development

Development costs made up 23m USD in the first half year.

Development of the Polkadot protocol and SDK (5.1m USD) features on items such as new host implementations like Gosammer (2.8m USD), interoperability standards like NFT XCM (730k USD) and support for Rust runtime verification (540k USD) and XCQ (310k USD). There is a significant uptick in costs for Data Services & Indexing (4.1m USD), as Polkadot has sought new integrations with data terminals like Dune (2.5m USD) and Token Terminal (1.4m USD).

3.9m USD went into wallets SubWallet (880k USD), Talisman (1.4m USD), and Nova (1.2m USD).

Investments into Governance (2.3m USD) capabilities include the Futarchy proposal from Zeitgeist (1m USD) and Project Glove (810k USD) intending to add a privacy-preserving layer to OpenGov. Lastly, SDKs (1.7mm USD) like ORML/Chopsticks/Subway (720k USD), Apillon (650k USD), and PAPI (180k USD) are making big steps to improve the developer experience.

Economy

Expenses in the economy section are fairly simple. In total, the Treasury spent 15m USD on liquidity incentives. Hydration and Stellaswap each received 1m DOT to be distributed within a year.

Talent & Education

Polkadot invested 5.5m USD in Talent & Education. Trainings & Hackathons (5m USD) make up the largest portion of that, with 3.1m USD for the Polkadot Blockchain Academy and numerous other hackathon series costing between 60k and 600k USD. Interestingly, there is also software development happening in this category, with the Polkadot Agents Program (360k USD) fleshing out a platform to help new community members connect with mentors and get trained in Polkadot.

Operations

Operations (3.8m USD) covers everything that keeps the network and core ecosystem components running. Notably, the biggest category is Governance (2.5m USD), with the Polkassembly costs for 2024 being covered with 1.8m USD. As an interesting new addition, OpenGov has funded a foundation in the Cayman Islands as a legal wrapper for 640k USD. Data Services and Indexing (330k USD) have been used for indexing service Subsquid. 760k USD have been paid for the Subscan block explorer. RPCs and Nodes come in with 500k USD.

Research

Research (2.1m USD) is our smallest category. A data storage system chain has been funded with 690k USD. Notable mentions are that OpenGov hired a virtual Chief Information Security Officer for 370k USD and is adding capabilities to investigate Treasury Spending through OG Tracker (210k USD)

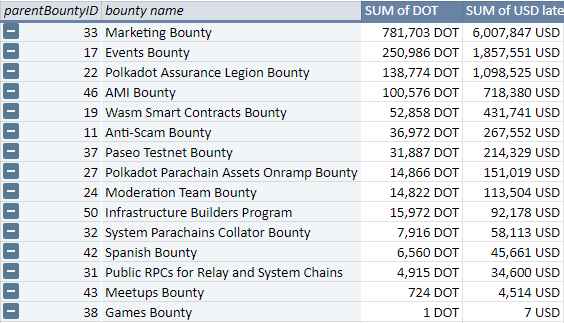

A Look into Bounties

Polkadot either pays directly, via bounties, or via collectives.

Collectives are the newest instrument in Polkadot’s arsenal, and salaries so far have totaled 103k USD. Much more interesting is the direct vs. bounty split: 75m USD has been spent directly, while 11m USD has been deployed via bounties.

Comparing against categories, we see that Polkadot has built an efficient infrastructure to deploy into outreach (9m USD, advertising, events) and to some extent development (1.7m USD, audits and smart contract capabilities). On the operations front, RPCs, nodes, and Paseo testnet infrastructure have received 400k USD from bounties. The Anti-Scam bounty paid out 267k USD.

Discussion

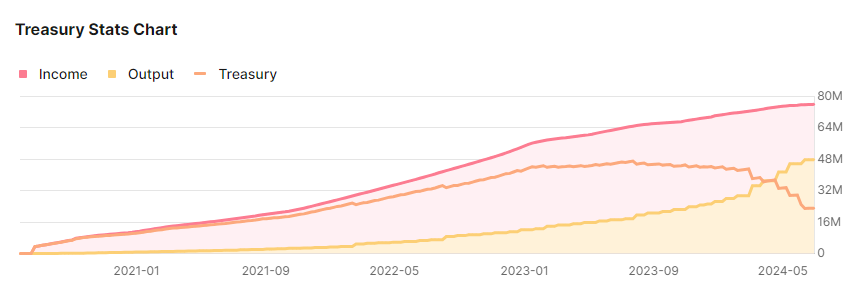

On the Topic of the Treasury burn rate

The Treasury has about 32m DOT (200m USD) in liquid assets available within the next year. At a net loss of currently 17m DOT (108m) USD per year, this leaves about 2 years of runway left, if the DOTUSD rate stays the same.

The volatile nature of a mostly DOT-denominated treasury makes it hard to predict the future, but concerns in the ecosystem about the usage of the Treasury are increasing. We want to briefly share a few thoughts and reflect on current discussions.

A simplified view of the situation is presented when looking at the Treasury main account balance turning sharply down.

While the balance sheet in this report highlights that the situation is not as dire as it seems, the concerns are substantiated nonetheless. Fear is not a good emotion to base decisions on, and so we should consider how to manage the situation rationally. How can Polkadot ensure that it deploys its capital meaningfully?

Centralized planning is not possible and it often seems that whoever makes the best proposal first captures the value.

First, let’s notice that there is a clear trend towards more structure. Executive bodies like bounties and collectives are increasingly forming and taking on departmental roles within the ecosystem. From security and data research to the development of core functionality and the operation of the network and marketing and business development activities, we see more and more people taking on responsibilities in this new system. The real question is: How can we quickly enough establish effective structures to guide Polkadot to success?

We think that the answer lies in giving more responsibility to those executive bodies. They are where competent people on certain topics are gathered, to judge new proposals and deliver value. Collectives are like subDAOs, having OpenGov capabilities and Sub-Treasuries at their disposal. Initiatives like the marketing bounty show that there are learning organisms within the greater system. OpenGov stakeholders should move more into the role of making the big decisions, and outsource the mundane operational questions to the executive bodies, stepping in only if effectiveness is not provided.

Effective deployment of Treasury capital in the future will likely happen by creating departments that are represented as bounties and collectives. OpenGov makes the big decisions and applies controlling for results. Executive bodies will be judged on effectiveness and performance. Budget will be negotiated by OpenGov on the basis of how to distribute budgets between those executive bodies. Optimistic Project Funding might pave the way.

On Inflation

While not a topic of Treasury management, inflation is one of the hottest topics at the moment. It is relevant to the Treasury, as a mostly DOT-denominated treasury derives its purchasing power from a solid DOTUSD exchange rate. So let’s indulge the discussion for a moment.

A recent wish-for-change referendum to reduce inflation ended very close with 57% against it, presumably because of the specific mechanics in the proposal.

DOT’s supply grows super-linearly with 10% of the existing supply per year.

This is not ideal, as many discussions around ecosystem tokenomics highlight. Most of the inflation goes into staking rewards. This would mean that at a market capitalization of 10 billion USD, 1 billion USD per year would be redistributed to stakers. A high price to secure the network. Too high, as many would conclude. It would be reasonable to assume that half the APR or even a linear or sub-linear effective inflation is equally able to incentivize honest actors the secure the network.

At the same time, reducing inflation would remove stress from DeFi protocol in the ecosystem, which has to in essence compete with the comparatively safe network staking of DOT. DOT’s staking APR is 15-20%, so any DeFi protocol that cannot offer those rewards is doomed to fail. A condition that is described as very harsh, even cruel, if you consult any investor who is active in TradFi.

Reducing DOT inflation would have many different effects. It would reduce sell pressure from those stakeholders that primarily stake to sell. It would create new incentives to inject DOT into the DeFi economy of Polkadot. And it would open up DOT to a new pool of potential stakeholders who see the current tokenomics as destructive.

Lastly, let us mention that many Polkadot community members are unhappy about the Treasury’s spending and the resulting DOT sell pressure. At the same time, they miss that sell pressure from stake-to-sell users can significantly outpace any selling pressure that the Treasury creates. It is reasonably within many stakeholders’ interest to advance the discussion on reducing inflation to remove pressure from OpenGov operations and create a calmer and more reasonable environment to advance the tech.

Notes

- The raw data for this report can be found in the following places:

- Google Sheet with pivot tables and charts: https://docs.google.com/spreadsheets/d/14jhH_zdDivhGqOzDyCGiTlH_s-WcPLRoXqwAsQvfNMw/edit?gid=1951394662#gid=1951394662

- Github: https://github.com/OpenGov-Watch/data/tree/main/2024-h1

- Data Acquisition Methodology

- We extend our thanks to the Subsquare, the Parity data team, and lolmcshizz for providing valuable data and inputs for this report.

- Balance sheet values

- an intra-day exchange rate of 6.4 DOTUSD was retrieved on 2024-06-28

- Cash and cash equivalent values are retrieved from Subscan

- DOT value in the Hydration Omnipool are retrieved from the Hydration UI

- DOT/USDC/USDT holdings from several accounts are retrieved from Subscan

- Bifrost liquidity is estimated on the basis of 17.24% APR after 4 months linear

- Outstanding wages payable are retrieved from the SubSquare collectives UI

- Bounty holdings are retrieved from SubSquare

- Income Statement

- Referenda and Child Bounties

- Were fetched by reverse-engineering Subsquare’s doTreasury API and transforming the data. Code is here

- Determination of DOT value:

- spend and spend_local DOT value is taken into consideration

- Bounty and XCM send values are assumed 0. Typically they just move DOT into designated accounts and later spending can then be recognized

- batch calls are traversed

- If the value is expressed in USDT/USDC, we calculate the DOT value of the closing price on the day of execution

- Determination of USD value

- If the value is given in USDT/USDC, that value is taken

- In all other cases, we use the DOT value and multiply with the closing price of the day of execution

- Full bounty spend: A single instance in the relevant timeframe is recorded. This was just manually taken from Subscan

- Inflation, Burn, Fees, and other values have been provided on a monthly basis from the Parity data team.

- Referenda and Child Bounties

- The report uses a cash accounting (for the most part)

- This means that expenses and income are recorded are made, not when the actual service is delivered.

- We strive to arrive at accrual accounting, as it is more in line with international accounting practices. But we lack the necessary data from spends and bounties.

- This can create distortions in many ways, for example when payments are made that extend over the measurement period, or when transactions (like the Myth swap or the Inter Miami deal) are prepaid but not yet executed (and might still fail and get refunded). Another example is the new spend() extrinsic, which we account for at the time of referendum execution. But as an extreme example, Ref 822 (likely to fail) would incur a future payment of 9.6m DOT over the timespan of 4 years, but be recorded instantly.

- The current report bases its numbers on the execution date of proposals, which can deviate from the time tokens are spent. For past reporting, we only represented direct spending from the Treasury and it was convenient to represent them on the date of spending.

- Expenses

- Loans and liquidity provisions are not represented in the income statement, as they do not count as expenses per accounting standards. They will show up on the balance sheet

- Bounty creation & bounty refills are also hidden since these are not yet expended but rather become designated assets. Once they are spent via child bounties (or in a single instance fully), expenses are accounted.

- Refunds: We record income from transfers to the Treasury. These transactions are most likely refunds from OpenGov proposers that have been overpaid or decided not to deliver. But tracking the origin of these transactions is out of the scope of this report

- This report is created by humans and might contain errors. Don’t trust, verify.